by Alice Gilman

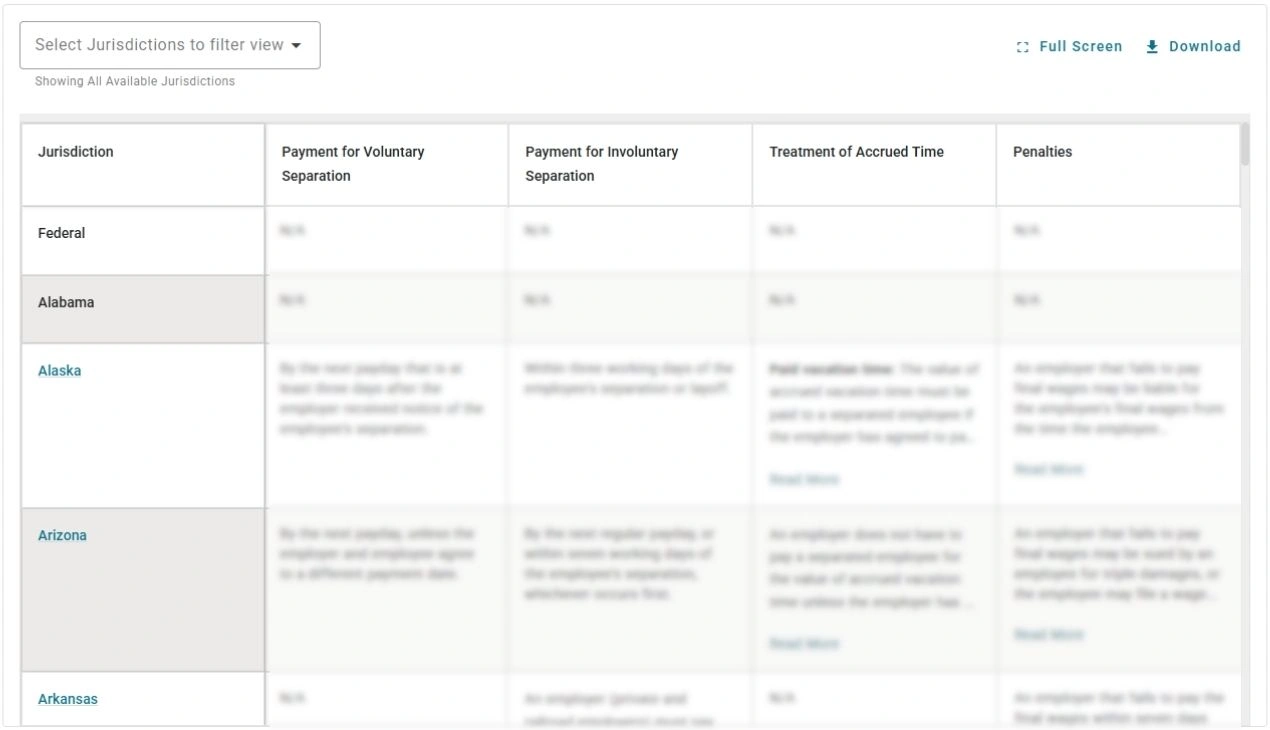

Ensuring timely and accurate final wage payments is a critical part of compliant and professional employee offboarding—and the rules differ widely across the United States. State wage payment laws outline when employers must issue final pay, and these timelines can vary based on whether the separation was voluntary, involuntary, temporary, or tied to a specific industry. HR teams must also navigate requirements for accrued but unused compensation, such as commissions or paid leave, which some states mandate be included in the final paycheck.

For employers managing remote or multistate workforces, compliance becomes even more complex. Companies must apply the correct state law for each worker, especially when handling unused vacation or sick time, as payout obligations differ dramatically by jurisdiction. Some states explicitly require payout, while others allow it only if outlined in an employer policy, contract, or collective bargaining agreement—and in certain states, localities have their own unique rules.

Our Final wage payment requirements by state chart gives HR and payroll leaders a clear, authoritative breakdown of every jurisdiction’s final pay deadlines, payout rules, and associated penalties for non‑compliance. Whether you’re handling a resignation, termination, or position elimination, this resource ensures your organization remains compliant, minimizes legal risk, and delivers a smooth, professional offboarding experience every time.

Want to see more?

For full access to Final wage payment requirements by state and municipality, sign up to a HR and Compliance Center subscription today.

You may also be interested in…

About the author

Alice Gilman

Alice Gilman, an employment tax compliance expert, has created two best-selling payroll compliance publications – Payroll Legal Alert, and The Payroll Compliance Handbook, currently published by Business Management Daily.

She was a contributing editor to Alexander Hamilton Institute’s Benefits Alert, Personnel Legal Alert, and Manager’s Legal Bulletin newsletters; the Complete Compliance Guide to Federal and State Employment Laws; the Complete COBRA Compliance Kit; the Complete FLSA Compliance Kit; and the Complete HIPAA Compliance Kit.

At Aspen Publishers, Ms. Gilman was a contributing editor to the Payroll Manager’s Letter, the American Payroll Association’s Basic Guide to Payroll, How to Slash Payroll Costs, and the Fingertip Guide to Payroll Practice.

Ms. Gilman is a graduate of the State University of New York at Albany and received her law degree from the University of Bridgeport.

She is admitted to the New York State Bar and is a member of the American Payroll Association.

Sign up to receive expert HR insights from Brightmine

Join our community and stay updated with industry trends, expert insights, valuable resources, webinar invites… and much more.

Sign up now and receive regular updates straight to your inbox!