by Susie Wine, Littler

Managing tipped employees requires HR teams to navigate a complex mix of federal, state, and local wage laws. While the Fair Labor Standards Act (FLSA) allows employers to apply a tip credit toward minimum wage, many states set stricter rules and some prohibit tip credits entirely. Understanding these variations is essential to maintaining wage‑and‑hour compliance and protecting your organisation from costly violations.

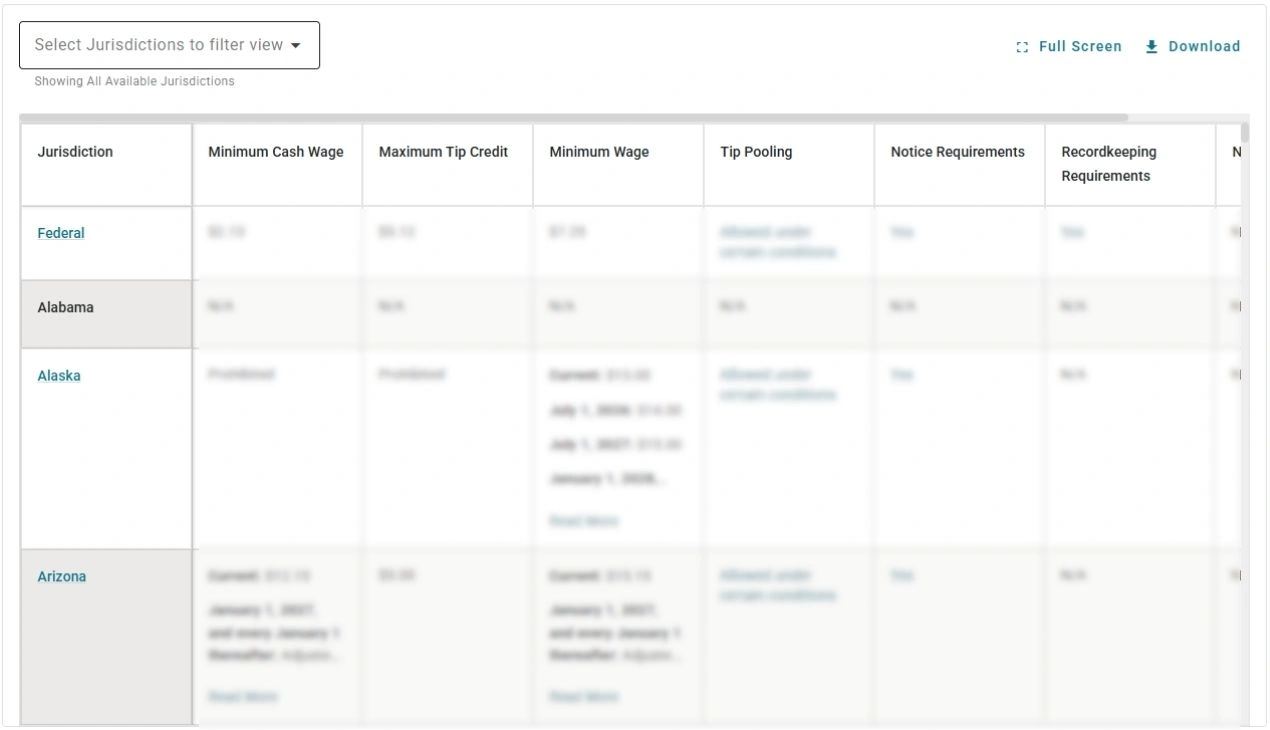

Employers must also stay informed on tip pooling requirements, which determine whether and how tips may be shared among staff. States differ widely in whether tip pooling is allowed, restricted, or simply not prohibited, and some jurisdictions impose specific notice and recordkeeping obligations for employers. HR teams need clear, up‑to‑date guidance to ensure tipped employees receive the correct minimum cash wage, are included in compliant pooling arrangements, and receive all legally required notifications.

Our Fifty state chart on tip credit and tip pooling provides a comprehensive state‑by‑state overview of tip credit allowances, minimum cash wage thresholds, and tip pooling rules.

With accurate insights tailored for HR, payroll, and compliance professionals, organisations can confidently build fair pay practices, strengthen compliance programs, and support a transparent tipping environment for employees.

Want to see more?

For full access to Tip credit and tip pooling by state and municipality, sign up to a HR and Compliance Center subscription today.

You may also be interested in…

Sign up to receive expert HR insights from Brightmine

Join our community and stay updated with industry trends, expert insights, valuable resources, webinar invites… and much more.

Sign up now and receive regular updates straight to your inbox!