by Alice Gilman

Managing payroll isn’t just about efficiency, it’s about staying compliant in a landscape where direct deposit requirements vary widely from state to state. As more employers rely on electronic wage payments for speed, security, and cost savings, understanding the rules that govern direct deposit becomes essential for HR teams striving to protect both their organization and their employees.

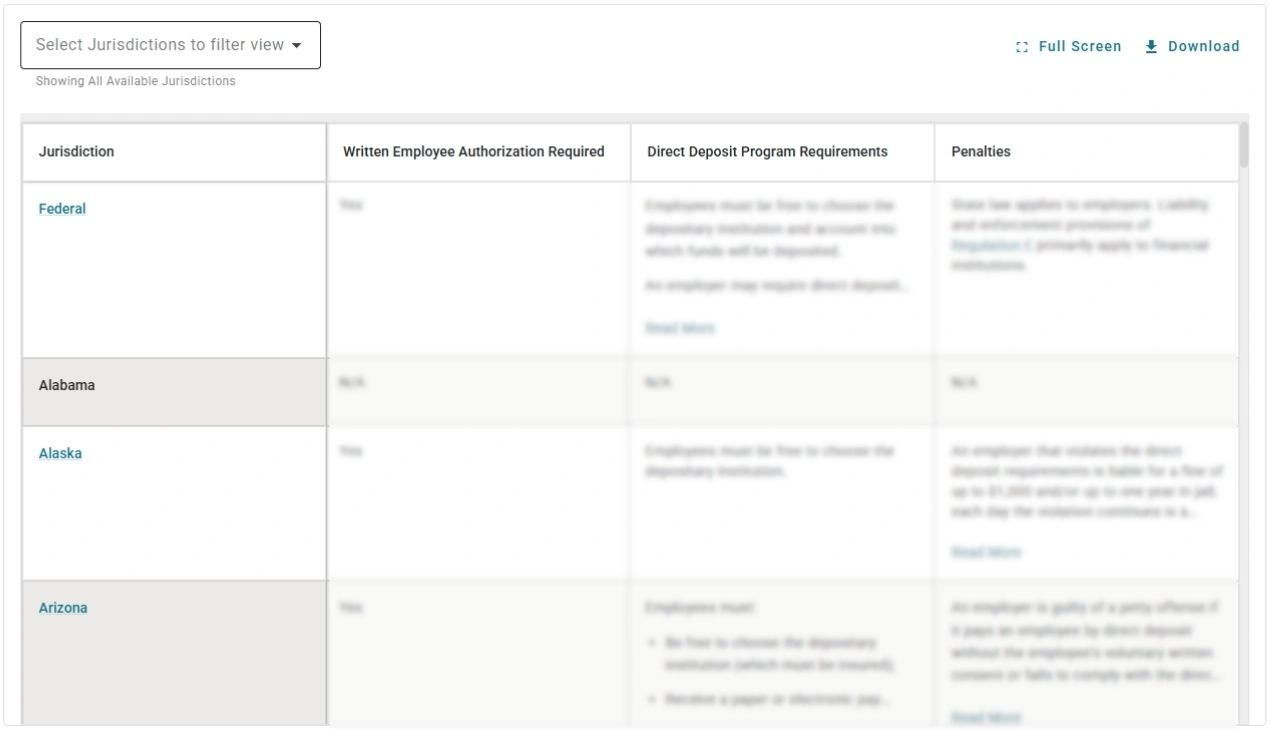

Our state-by-state guide to direct deposit laws gives HR professionals a clear, authoritative resource to navigate complex wage payment regulations. While federal Regulation E establishes overarching standards for electronic payments, many states introduce additional protections and restrictions, from prohibitions on mandatory direct deposit to requirements for employee consent and pay statement access.

Whether your organization operates in one state or nationwide, this comprehensive overview empowers HR and payroll leaders to ensure compliance, reduce risk, and streamline wage payment processes—all with the confidence that comes from having accurate, up‑to‑date guidance at your fingertips.

Want to see more?

For full access to Direct deposit laws by state, sign up to a HR and Compliance Center subscription today.

You may also be interested in…

About the author

Alice Gilman

Alice Gilman, an employment tax compliance expert, has created two best-selling payroll compliance publications – Payroll Legal Alert, and The Payroll Compliance Handbook, currently published by Business Management Daily.

She was a contributing editor to Alexander Hamilton Institute’s Benefits Alert, Personnel Legal Alert, and Manager’s Legal Bulletin newsletters; the Complete Compliance Guide to Federal and State Employment Laws; the Complete COBRA Compliance Kit; the Complete FLSA Compliance Kit; and the Complete HIPAA Compliance Kit.

At Aspen Publishers, Ms. Gilman was a contributing editor to the Payroll Manager’s Letter, the American Payroll Association’s Basic Guide to Payroll, How to Slash Payroll Costs, and the Fingertip Guide to Payroll Practice.

Ms. Gilman is a graduate of the State University of New York at Albany and received her law degree from the University of Bridgeport.

She is admitted to the New York State Bar and is a member of the American Payroll Association.

Sign up to receive expert HR insights from Brightmine

Join our community and stay updated with industry trends, expert insights, valuable resources, webinar invites… and much more.

Sign up now and receive regular updates straight to your inbox!