by Alice Gilman

Understanding how each state aligns with the federal Internal Revenue Code (IRC) is essential for HR and payroll teams managing multi‑state compliance. States vary widely in their approach: some adopt the current federal definition of wages automatically, while others follow an earlier version of the IRC or apply their own exceptions to certain types of income or benefits. Because taxable wage definitions form the basis for accurate withholding, employers must know exactly which version of the IRC each state uses.

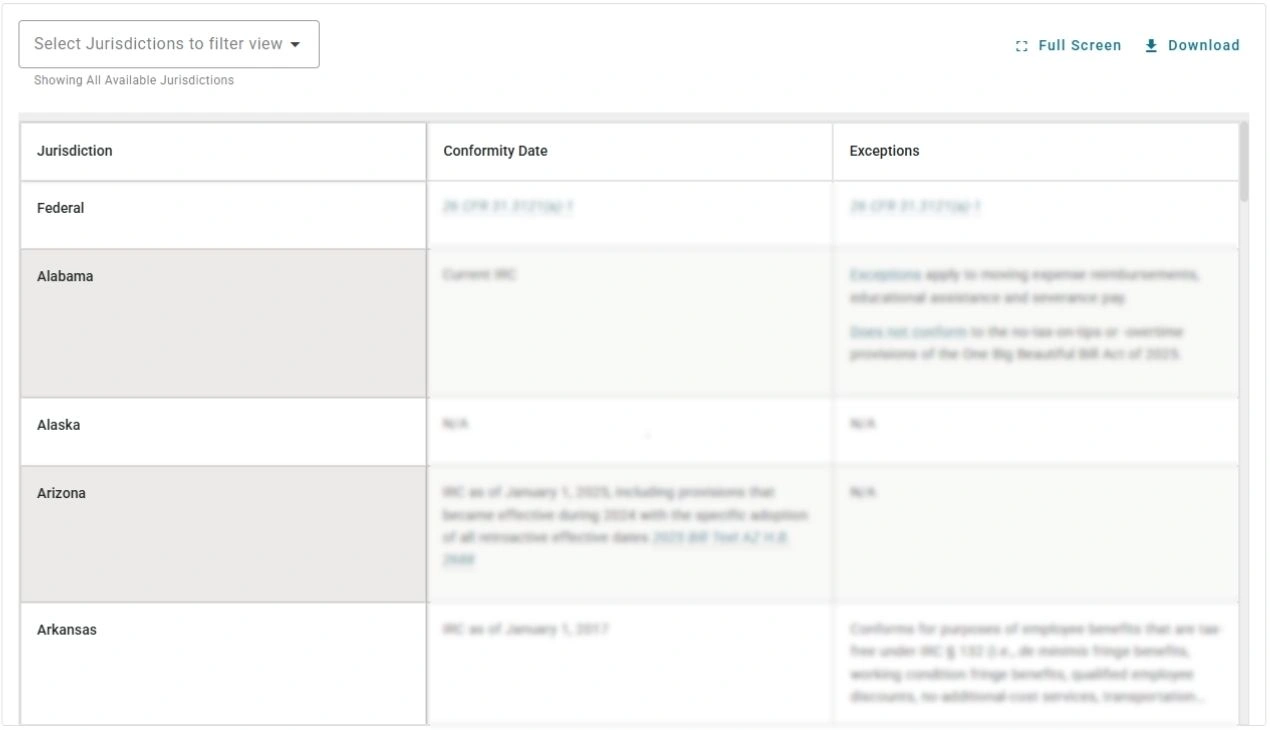

Our Fifty state chart for Internal revenue code conformity offers HR and payroll professionals a clear, consolidated view of each state’s IRC conformity status. This comprehensive comparison helps organizations quickly identify how wage definitions differ across jurisdictions, stay ahead of compliance changes, and ensure accurate payroll operations.

Designed to support employers with diverse and distributed workforces, the chart provides a streamlined way to reduce risk, improve compliance accuracy, and navigate evolving tax rules with confidence.

Want to see more?

For full access to Internal revenue code conformity by state, sign up to a HR and Compliance Center subscription today.

You may also be interested in…

About the author

Alice Gilman

Alice Gilman, an employment tax compliance expert, has created two best-selling payroll compliance publications – Payroll Legal Alert, and The Payroll Compliance Handbook, currently published by Business Management Daily.

She was a contributing editor to Alexander Hamilton Institute’s Benefits Alert, Personnel Legal Alert, and Manager’s Legal Bulletin newsletters; the Complete Compliance Guide to Federal and State Employment Laws; the Complete COBRA Compliance Kit; the Complete FLSA Compliance Kit; and the Complete HIPAA Compliance Kit.

At Aspen Publishers, Ms. Gilman was a contributing editor to the Payroll Manager’s Letter, the American Payroll Association’s Basic Guide to Payroll, How to Slash Payroll Costs, and the Fingertip Guide to Payroll Practice.

Ms. Gilman is a graduate of the State University of New York at Albany and received her law degree from the University of Bridgeport.

She is admitted to the New York State Bar and is a member of the American Payroll Association.

Sign up to receive expert HR insights from Brightmine

Join our community and stay updated with industry trends, expert insights, valuable resources, webinar invites… and much more.

Sign up now and receive regular updates straight to your inbox!