by Brightmine Editorial Team

When an employee passes away, HR and payroll teams must navigate highly specific state rules that determine how final wages can be paid—and to whom.

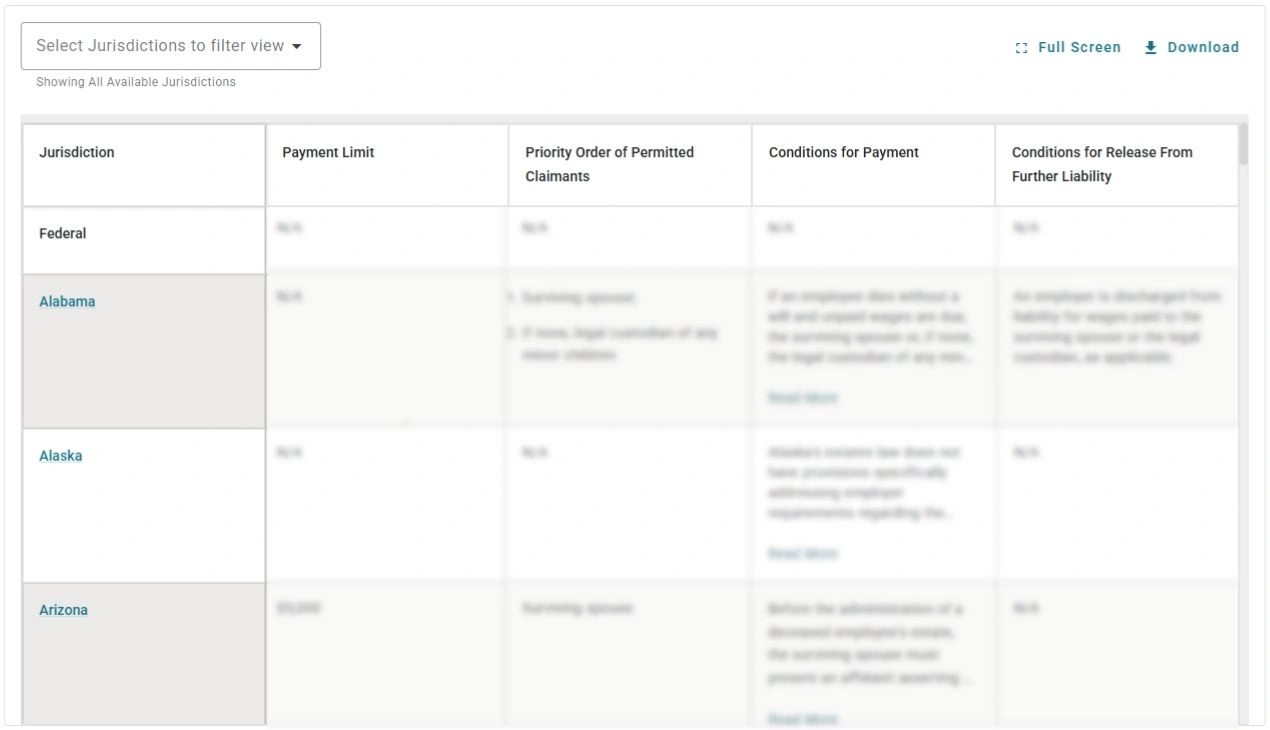

State laws vary widely: many outline payment limits, define who is legally entitled to receive the wages (such as a surviving spouse, next of kin, or a court‑appointed representative), and specify the conditions and documentation required before payment can be released. These rules are often embedded in wage‑payment statutes or estate laws, creating a complex compliance landscape that employers must follow with precision.

Our Fifty state guide to deceased employee wages gives HR professionals a clear, consolidated reference for understanding these requirements across all 50 states. It highlights state‑specific payment thresholds, claimant priority order, and the procedures employers must use to ensure they are properly discharging wage obligations—and protecting the organization from further liability.

Give your HR and payroll teams the confidence, accuracy, and legal clarity they need during one of the most sensitive and regulated payroll scenarios with our comprehensive 50‑state guide.

Want to see more?

For full access to Deceased employee wages by state, sign up to a HR and Compliance Center subscription today.

You may also be interested in…

About the author

Our in-house team of HR experts carefully monitors and updates the Brightmine HR & Compliance Center, the most comprehensive library of employment law and HR resources. This team has an unrivaled wealth of subject matter expertise, with an average of 15 years’ experience. They also bring invaluable, diverse career experiences to the table—the team includes seasoned employment law attorneys, former in-house counsel, SHRM certified professionals and career employment law editors.

In addition to managing the HR & Compliance Center, the Editorial Team supports the content across the Brightmine product portfolio. The Team also supports Marketing Resource Center with breaking HR news, Commentary and Insights, and expert review of key compliance resources, such as our free charts.

Follow Brightmine on LinkedIn

Want to learn more?

Sign up for a FREE 7 day trial and access subscriber-only articles and tools.