by Vicki M. Lambert, The Payroll Advisor

Understanding how each state defines “wages” is essential for HR and payroll teams aiming to maintain accurate, compliant pay practices across multiple jurisdictions. Because the federal Fair Labor Standards Act does not provide a specific definition of wages, employers must rely on state wage payment laws—which vary widely and often include detailed rules about what counts as wages, how certain payments are treated, and which earnings must be included in wage calculations.

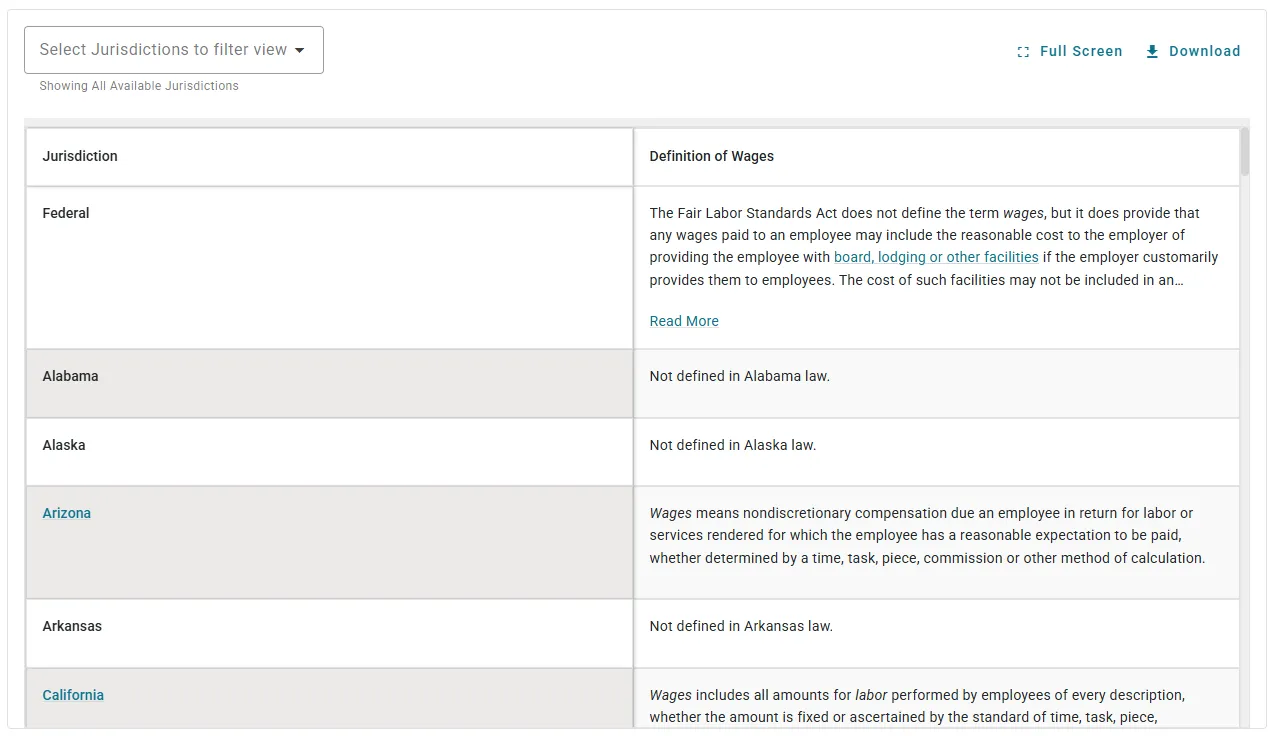

Our Fifty State Chart for Wage Definitions gives HR professionals a clear, consolidated view of these legal definitions across all 50 states. It outlines how states classify wages, notes when guidance comes from labor agencies rather than statutes, and highlights related considerations such as commissions, bonuses, vacation payouts, and pay‑deduction rules when they appear within state definitions. This makes it easier for HR teams to ensure every employee is paid correctly—and in full compliance with state‑specific requirements.

Equip your organization with a reliable, state‑by‑state reference designed to strengthen payroll accuracy, reduce compliance risk, and support consistent wage practices nationwide.

Want to see more?

For full access to Definition of Wages by State, sign up to a HR and Compliance Center subscription today.

You may also be interested in…

About the author

Vicki M. Lambert, The Payroll Advisor

Vicki M. Lambert, CPP has over 30 years of hands-on experience in all facets of payroll functions and over 20 years as a trainer and author. She has conducted open market training seminars and lectured extensively on payroll administration and compliance issues for clients such as ADP, CCH Incorporated, Ceridian Employer Services, and The Employer Group.

She conceived, coordinated and wrote the manuals for the Payroll Practice and Management certificate program offered through the Extended Education Offices of Chapman University, California State University Long Beach; National University; and California State University, Northridge.

Want to learn more?

Sign up for a FREE 7 day trial and access subscriber-only articles and tools.