by Brightmine Editorial Team

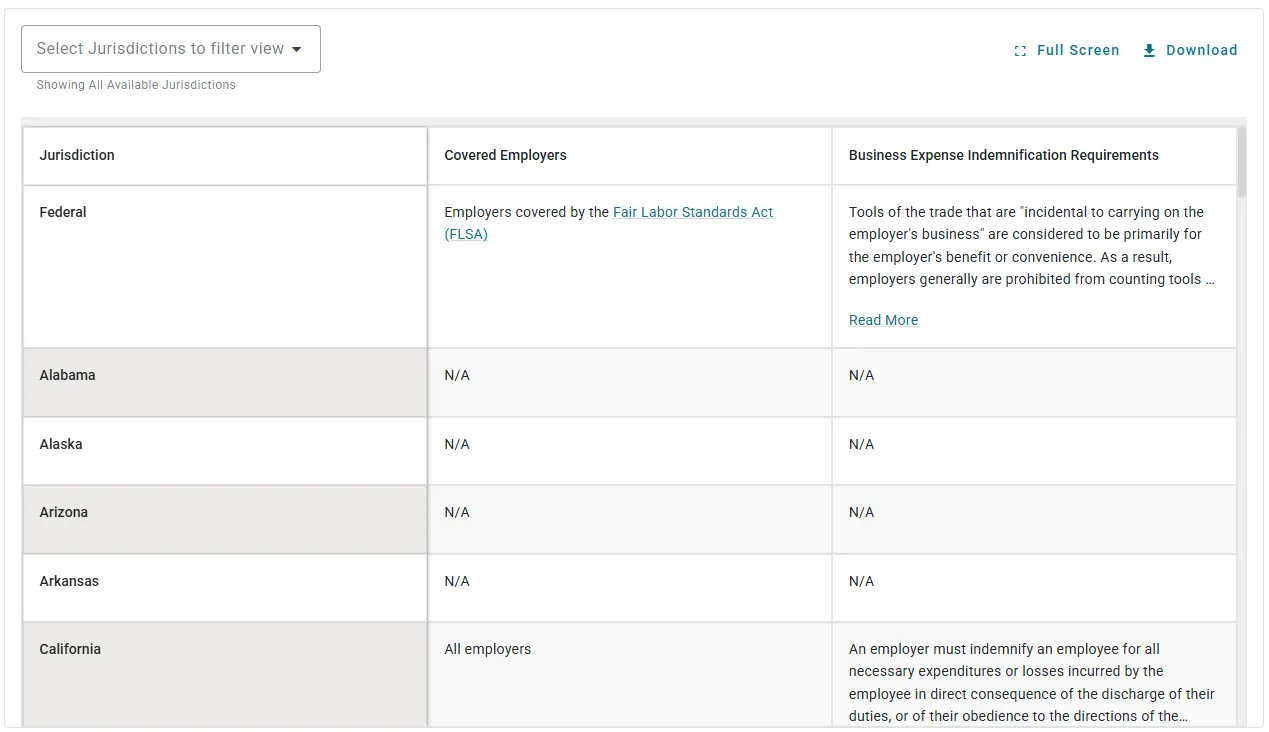

Business expense reimbursement laws vary widely across the U.S.—and HR teams need clear, reliable guidance to avoid costly pay‑practice mistakes. While federal law does not generally require employers to reimburse business expenses unless failing to do so would push an employee’s earnings below minimum wage and any overtime they may be owed., many states and municipalities impose their own reimbursement requirements. Some mandate explicit reimbursement for necessary work‑related expenses, while others interpret wage and deduction rules broadly, creating significant compliance differences across jurisdictions.

Our Fifty State Guide to Business Expense Reimbursement Requirements helps HR and payroll professionals navigate these state‑specific rules with confidence. It summarizes reimbursement obligations, identifies where costs must be employer‑paid, and clarifies how related issues—such as permitted deductions, service‑letter obligations, ADA‑related reimbursable expenses, and remote‑work cost rules—may impact compensation practices.

Empower your organization with a comprehensive, easy‑to‑use resource designed to reduce risk, support compliant pay policies, and standardize your approach to employee expense reimbursement across all 50 states.

Want to see more?

For full access to Business Expense Reimbursement Requirements by State and Municipality, sign up to a HR and Compliance Center subscription today.

You may also be interested in…

About the author

Our in-house team of HR experts carefully monitors and updates the Brightmine HR & Compliance Center, the most comprehensive library of employment law and HR resources. This team has an unrivaled wealth of subject matter expertise, with an average of 15 years’ experience. They also bring invaluable, diverse career experiences to the table—the team includes seasoned employment law attorneys, former in-house counsel, SHRM certified professionals and career employment law editors.

In addition to managing the HR & Compliance Center, the Editorial Team supports the content across the Brightmine product portfolio. The Team also supports Marketing Resource Center with breaking HR news, Commentary and Insights, and expert review of key compliance resources, such as our free charts.

Follow Brightmine on LinkedIn

Want to learn more?

Sign up for a FREE 7 day trial and access subscriber-only articles and tools.