by Alice Gilman

Staying compliant with state‑specific pay deduction laws is essential for HR and payroll teams working to minimize risk, protect employees, and ensure accurate wage payments. Many states enforce wage payment rules that go beyond the federal Fair Labor Standards Act (FLSA), creating stricter standards on which deductions are allowed or prohibited.

Because these regulations vary widely across U.S. jurisdictions, employers must understand the most stringent requirements to avoid penalties and maintain full compliance. Properly navigating these differences helps ensure HR teams follow lawful payroll practices.

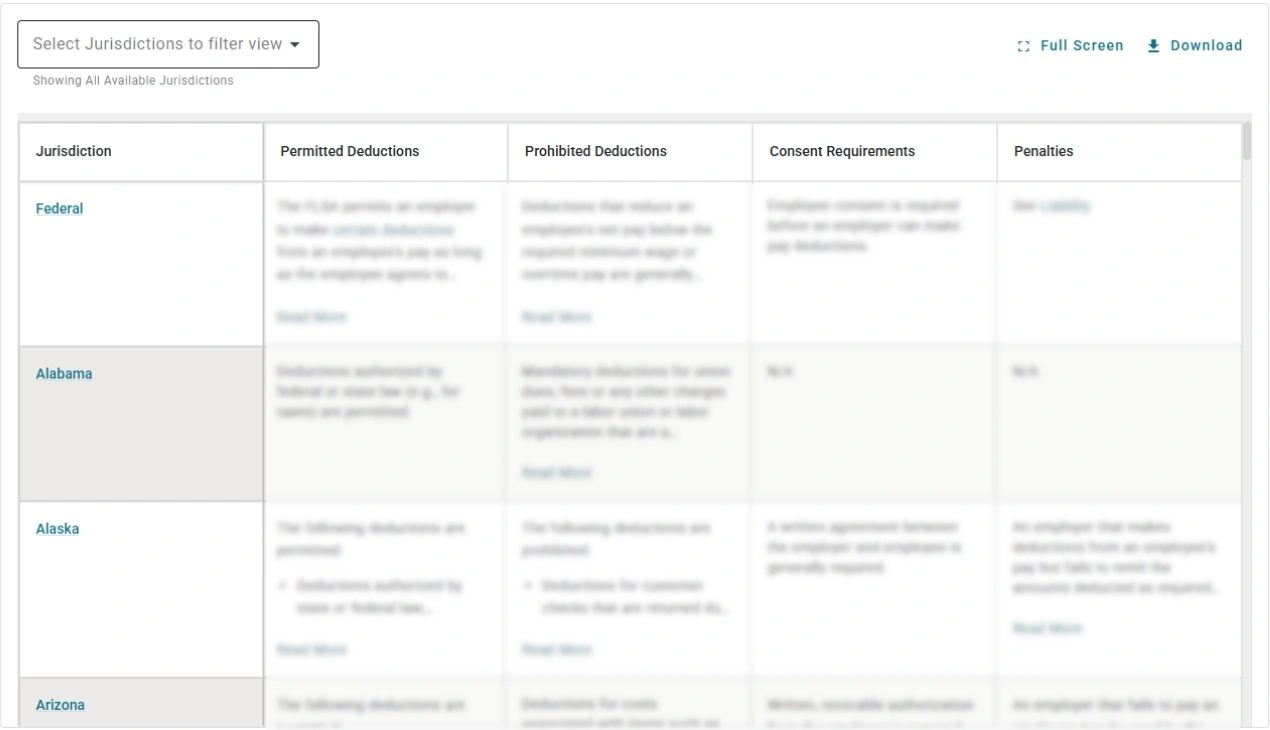

Ourt Fifty state chart delivers clear, up‑to‑date guidance on permitted and prohibited deductions across all states and municipalities, giving HR professionals the insight they need to manage payroll obligations confidently. The state‑by‑state information supports better payroll accuracy, stronger compliance, and a more transparent employee experience nationwide.

Want to see more?

For full access to Permitted and prohibited pay deductions by state and municipality, sign up to a HR and Compliance Center subscription today.

You may also be interested in…

About the author

Alice Gilman

Alice Gilman, an employment tax compliance expert, has created two best-selling payroll compliance publications – Payroll Legal Alert, and The Payroll Compliance Handbook, currently published by Business Management Daily.

She was a contributing editor to Alexander Hamilton Institute’s Benefits Alert, Personnel Legal Alert, and Manager’s Legal Bulletin newsletters; the Complete Compliance Guide to Federal and State Employment Laws; the Complete COBRA Compliance Kit; the Complete FLSA Compliance Kit; and the Complete HIPAA Compliance Kit.

At Aspen Publishers, Ms. Gilman was a contributing editor to the Payroll Manager’s Letter, the American Payroll Association’s Basic Guide to Payroll, How to Slash Payroll Costs, and the Fingertip Guide to Payroll Practice.

Ms. Gilman is a graduate of the State University of New York at Albany and received her law degree from the University of Bridgeport.

She is admitted to the New York State Bar and is a member of the American Payroll Association.

Sign up to receive expert HR insights from Brightmine

Join our community and stay updated with industry trends, expert insights, valuable resources, webinar invites… and much more.

Sign up now and receive regular updates straight to your inbox!