by Alice Gilman

Ensuring employees are paid accurately and on time is a core compliance responsibility for HR and payroll teams. State wage payment laws govern how often employees must be paid and how soon they must receive wages after performing work, with requirements that vary significantly across jurisdictions.

While federal law only requires employers to pay workers “promptly,” most states mandate specific pay periods—such as weekly, biweekly, semimonthly, or monthly—and enforce strict limits on allowable lag time between the end of a pay period and the actual payday. Failing to follow these rules can expose employers to penalties, fines, and wage claims.

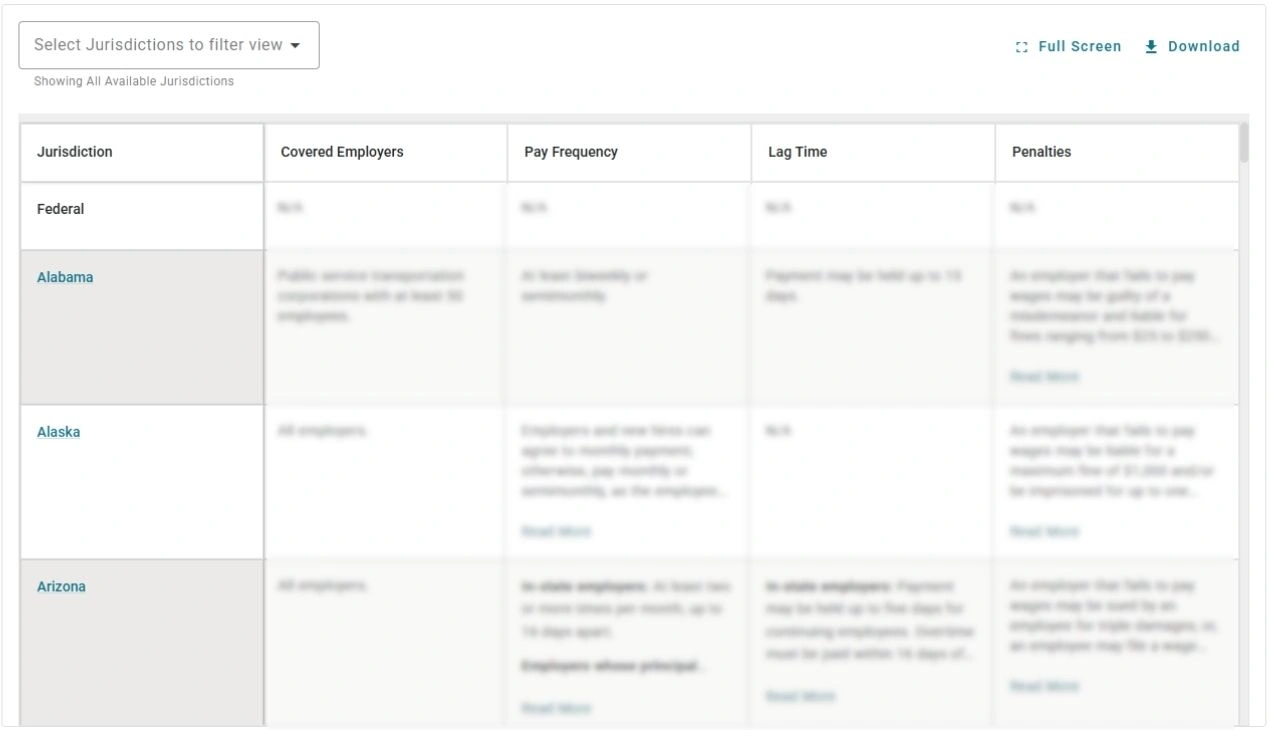

Our Fifty state chart for pay frequency and lag time requirements gives HR professionals a clear, comprehensive comparison of state and local pay frequency and lag time requirements.

This resource streamlines multi‑state payroll compliance by summarizing mandated pay periods, timing rules, and potential penalties—helping HR teams maintain consistent, compliant payroll practices across all locations.

Want to see more?

For full access to Pay frequency and lag time rRequirements by state and municipality, sign up to a HR and Compliance Center subscription today.

You may also be interested in…

About the author

Alice Gilman

Alice Gilman, an employment tax compliance expert, has created two best-selling payroll compliance publications – Payroll Legal Alert, and The Payroll Compliance Handbook, currently published by Business Management Daily.

She was a contributing editor to Alexander Hamilton Institute’s Benefits Alert, Personnel Legal Alert, and Manager’s Legal Bulletin newsletters; the Complete Compliance Guide to Federal and State Employment Laws; the Complete COBRA Compliance Kit; the Complete FLSA Compliance Kit; and the Complete HIPAA Compliance Kit.

At Aspen Publishers, Ms. Gilman was a contributing editor to the Payroll Manager’s Letter, the American Payroll Association’s Basic Guide to Payroll, How to Slash Payroll Costs, and the Fingertip Guide to Payroll Practice.

Ms. Gilman is a graduate of the State University of New York at Albany and received her law degree from the University of Bridgeport.

She is admitted to the New York State Bar and is a member of the American Payroll Association.

Sign up to receive expert HR insights from Brightmine

Join our community and stay updated with industry trends, expert insights, valuable resources, webinar invites… and much more.

Sign up now and receive regular updates straight to your inbox!