by Brightmine Editorial Team

Clear, compliant wage communication is essential for HR and payroll teams. However, pay statement and pay rate notification requirements vary significantly across states and localities.

Most jurisdictions require employers to provide a pay statement each payday that summarizes wages and explains how pay was calculated. Many states also mandate additional details, such as deductions, hours worked, and available paid leave.

Some states and municipalities require employers to issue separate pay rate notices at the time of hire or whenever pay information changes. Because there are no federal laws governing these requirements, employers must rely on state‑specific rules to stay compliant.

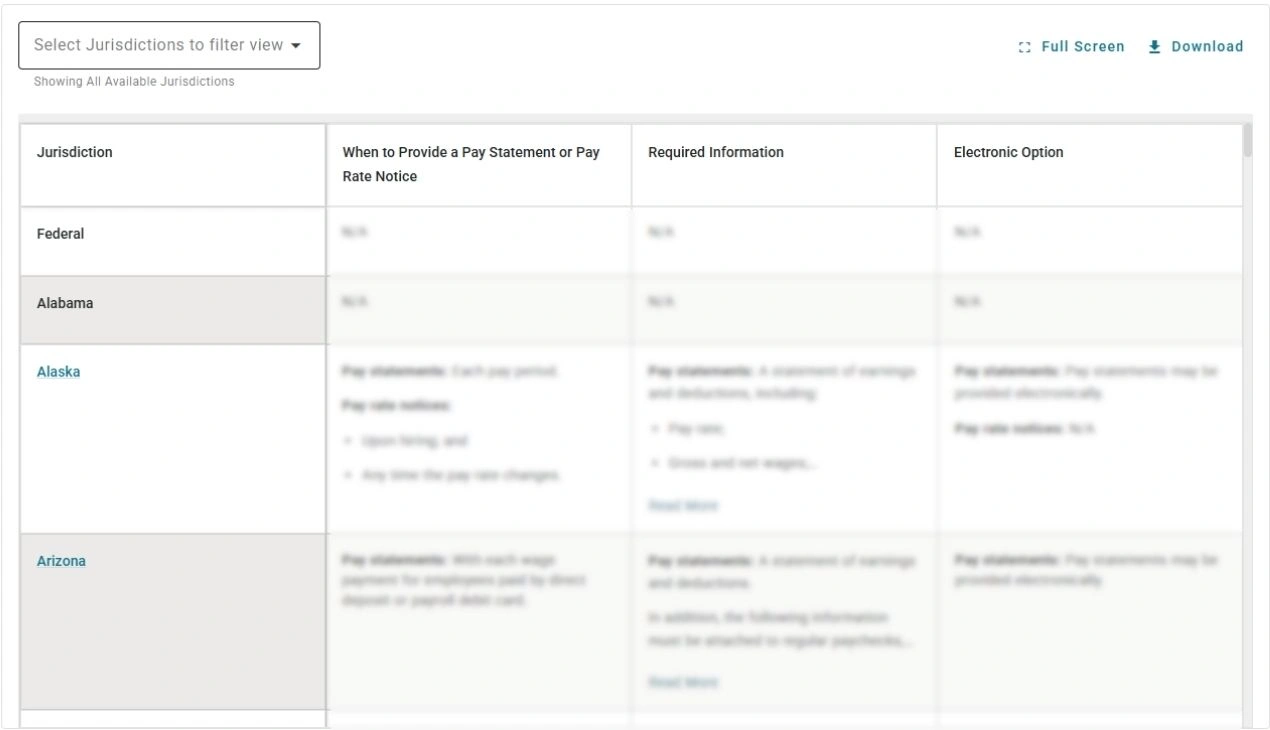

Our Fifty state chart for pay statement and pay rate notification requirements helps HR professionals navigate these complexities by offering a clear comparison of state and local pay statement and rate notice obligations.

This resource summarizes required paystub details, notice timing, electronic delivery rules, and state‑specific updates—empowering HR teams to reduce compliance risk and maintain accurate wage communication across all jurisdictions.

Want to see more?

For full access to Pay statement and pay rate notification requirements by state and municipality, sign up to a HR and Compliance Center subscription today.

You may also be interested in…

About the author

Our in-house team of HR experts carefully monitors and updates the Brightmine HR & Compliance Center, the most comprehensive library of employment law and HR resources. This team has an unrivaled wealth of subject matter expertise, with an average of 15 years’ experience. They also bring invaluable, diverse career experiences to the table—the team includes seasoned employment law attorneys, former in-house counsel, SHRM certified professionals and career employment law editors.

In addition to managing the HR & Compliance Center, the Editorial Team supports the content across the Brightmine product portfolio. The Team also supports Marketing Resource Center with breaking HR news, Commentary and Insights, and expert review of key compliance resources, such as our free charts.

Follow Brightmine on LinkedIn

Sign up to receive expert HR insights from Brightmine

Join our community and stay updated with industry trends, expert insights, valuable resources, webinar invites… and much more.

Sign up now and receive regular updates straight to your inbox!