by Brightmine Editorial Team

Managing state income tax withholding is one of the most complex challenges HR and payroll teams face, especially when employees work across multiple states or remotely. Withholding requirements vary significantly by jurisdiction—from states with no income tax to those with detailed reciprocal agreements and nonresident rules—and even small mistakes can lead to costly penalties and time‑consuming payroll corrections.

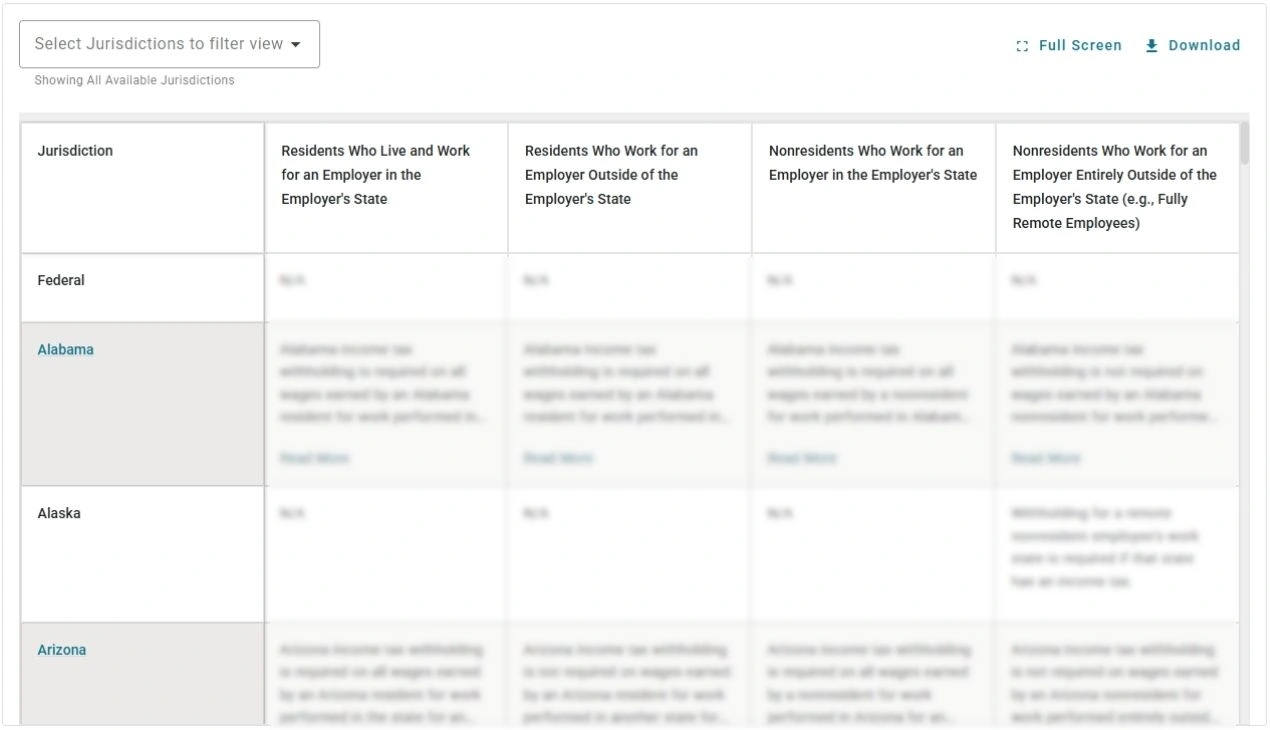

Our Fifty state chart on Income tax withholding requirements provides HR and payroll leaders with a clear, comprehensive comparison of withholding obligations for resident and nonresident employees. The chart outlines how multi‑state work arrangements affect payroll, when reciprocity or exemptions may apply, and what employers must consider to remain fully compliant.

Designed to support organizations with distributed workforces, this tool helps ensure accurate, consistent withholding no matter where employees live or perform their work.

Want to see more?

For full access to Income tax withholding requirements by state, sign up to a HR and Compliance Center subscription today.

You may also be interested in…

About the author

Our in-house team of HR experts carefully monitors and updates the Brightmine HR & Compliance Center, the most comprehensive library of employment law and HR resources. This team has an unrivaled wealth of subject matter expertise, with an average of 15 years’ experience. They also bring invaluable, diverse career experiences to the table—the team includes seasoned employment law attorneys, former in-house counsel, SHRM certified professionals and career employment law editors.

In addition to managing the HR & Compliance Center, the Editorial Team supports the content across the Brightmine product portfolio. The Team also supports Marketing Resource Center with breaking HR news, Commentary and Insights, and expert review of key compliance resources, such as our free charts.

Follow Brightmine on LinkedIn

Sign up to receive expert HR insights from Brightmine

Join our community and stay updated with industry trends, expert insights, valuable resources, webinar invites… and much more.

Sign up now and receive regular updates straight to your inbox!